Personal Loans in Ontario, Canada

The truth of reality is that money is a strong controlling force in our lives. It is probably the biggest one, to be honest. A balanced financial life can open up so many doors for you. Education, daily expenses, and generally comfortable life are all the rewards of a good financial life in Ontario,

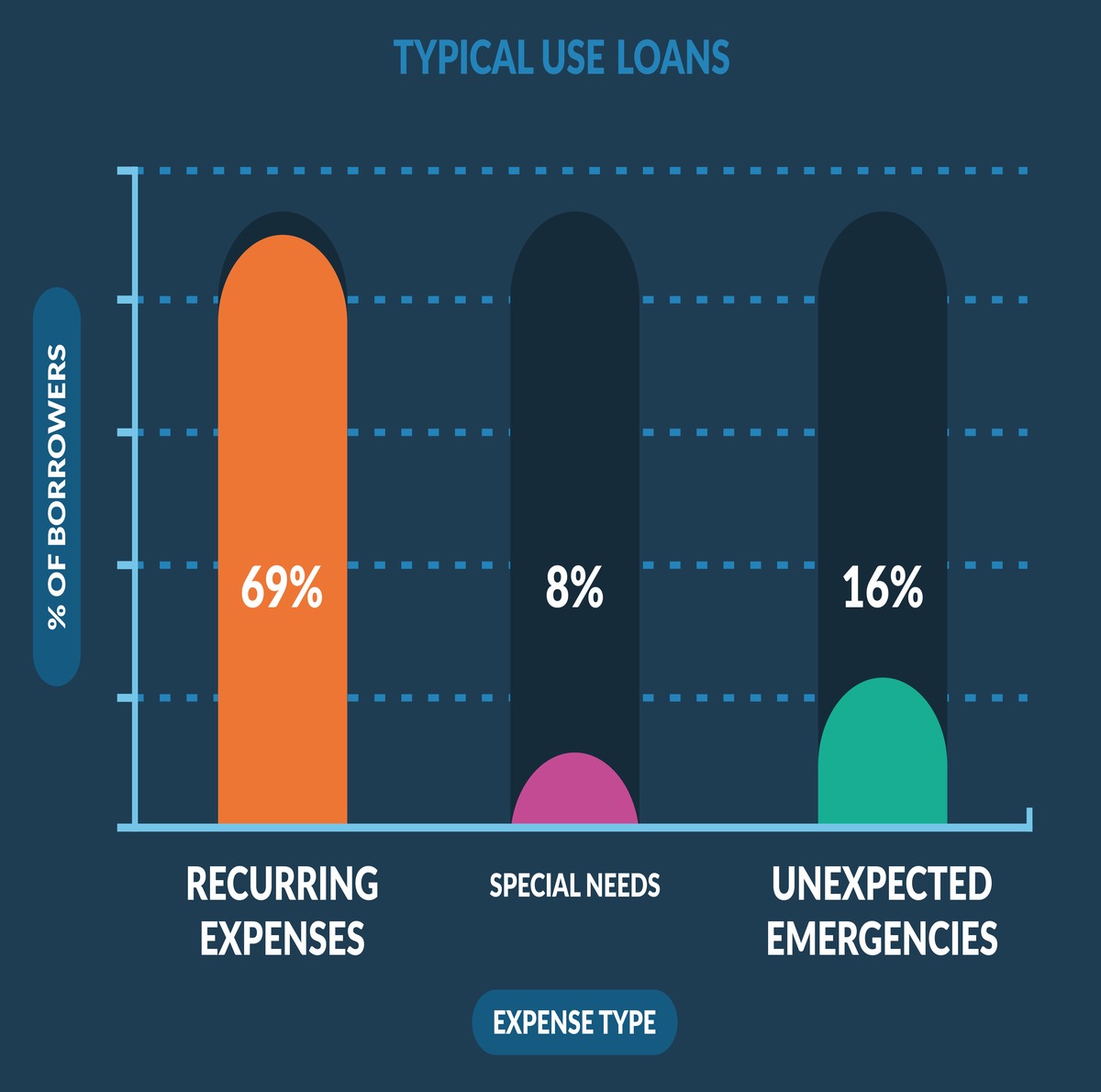

But as all people from Ontario, more specifically Toronto and the Greater Toronto Area are aware, a good financial base is a hard dream to achieve on your own. It takes a whole lot of effort to get to somewhere you are mildly comfortable but even then you are one emergency away from losing it all. Sometimes all we need is a push, a boost to help us get on our feet. This push could help our budding business, pay our extensive bills or could just get us out of a rut.

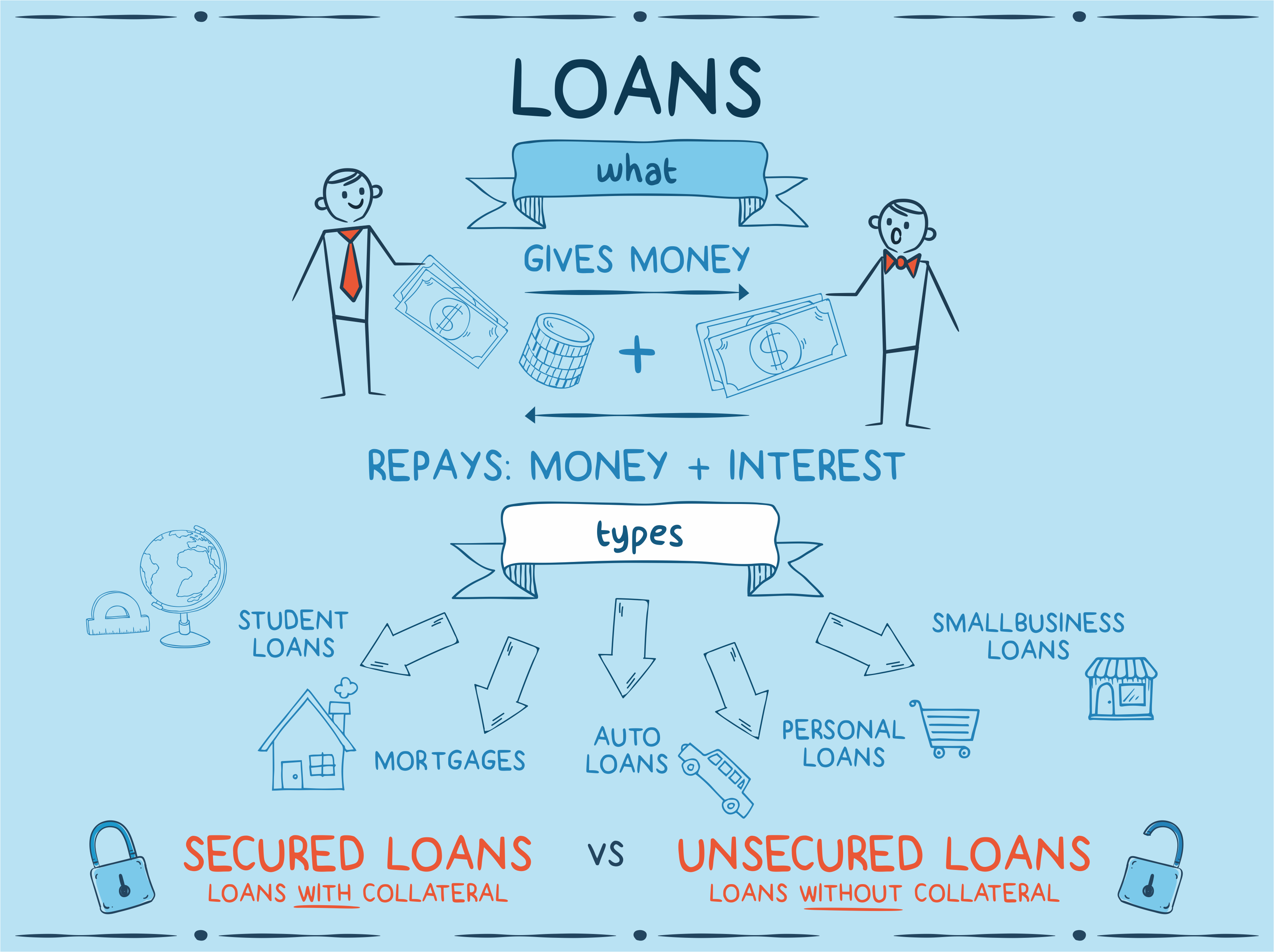

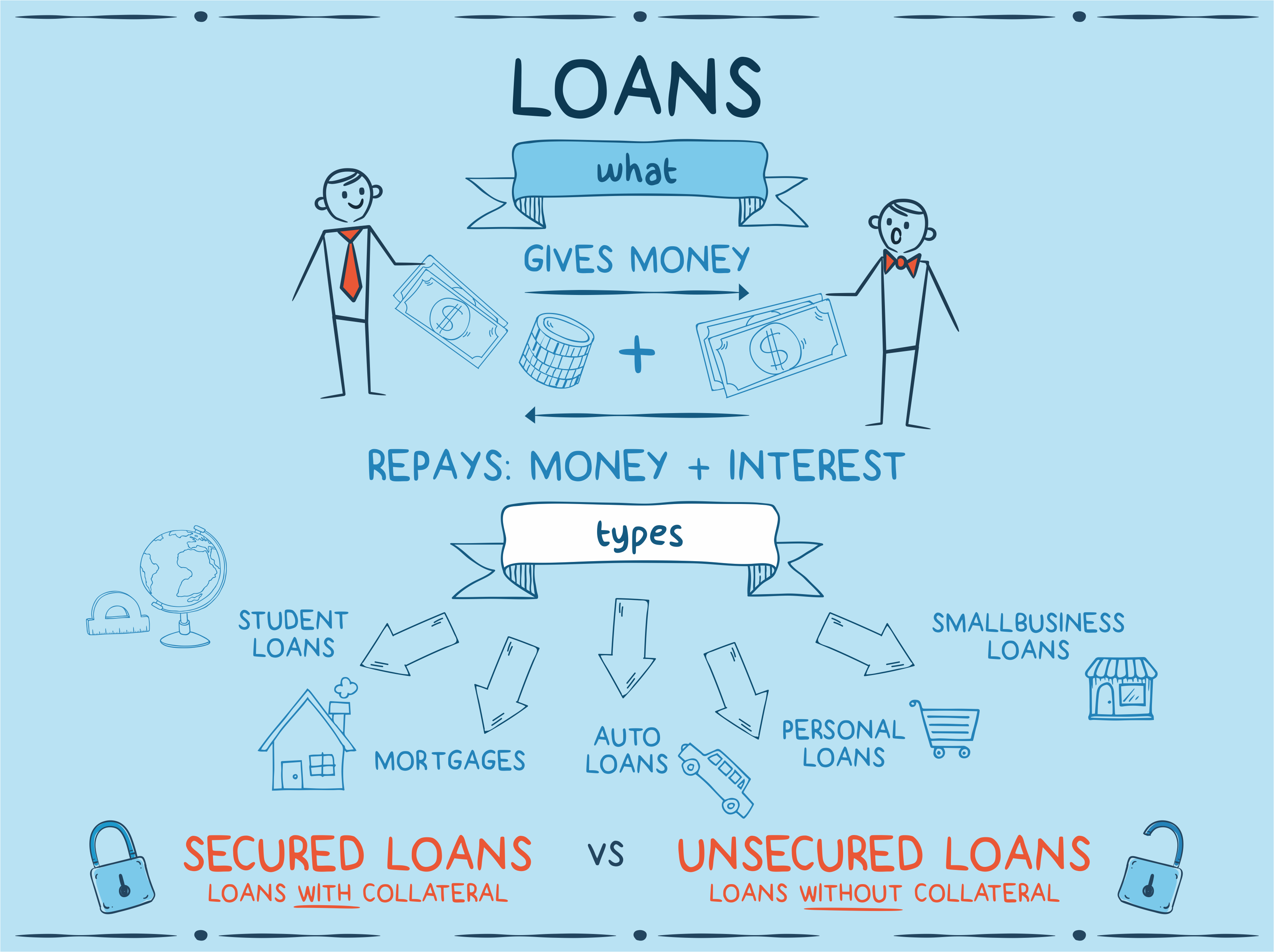

Whatever is keeping us down, it can eventually be fought back. This is where loans come in. Borrowing money can help the most struggling individual fight their current situations and get back on their feet in Ontario. They are famously easy to attain, so long as you have the appropriate paperwork to back you. Bad credit loans also have great approval rate so do not worry if you have a poor financial history.

Nothing is holding you down except your own self. Get these funds, go out, and fulfill your dreams. But first, you must know all about the different types of loans ($5000, $4000, $3000, $2000, and $1000) such as:

Let us take a look at locations where our company helps people:

Ontario (Toronto, Brampton, Oshawa, London, Vaughn, Ottawa, etc.)

We have a big variety of loans available at your disposal:

Online Loans in Ontario

As the name suggests, these loans can be used for anything you want. You do not have to tell your lender why you need the money. As long as you can show your ability to pay back you are good to go.

How to Get Bad Credit Loans in Ontario?

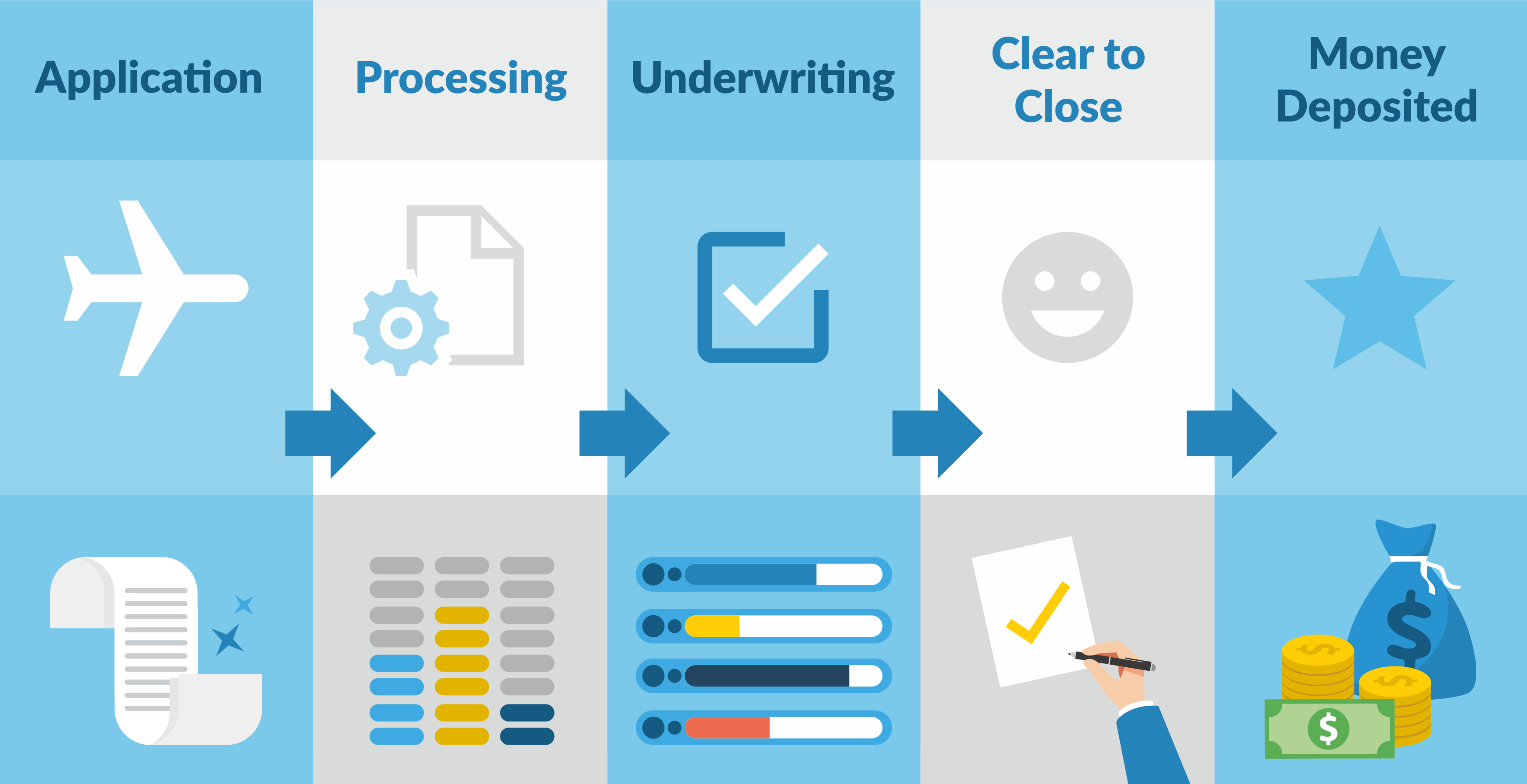

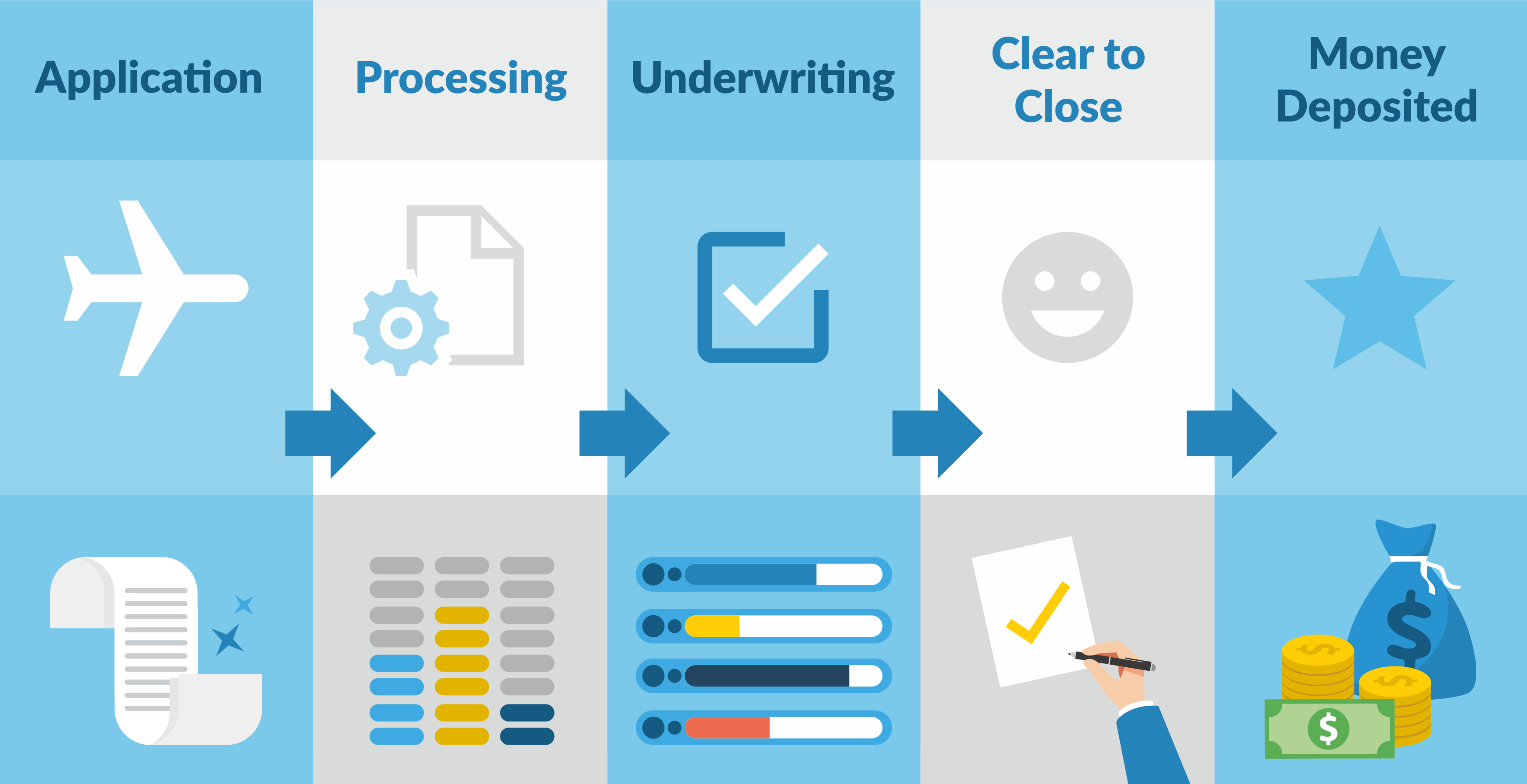

1. To acquire these loans, you must present proof of employment, a payroll, or pay stubs.

2. The lender will then calculate the applicant ’s principal by percentage and allow him/her to choose the amortization period.

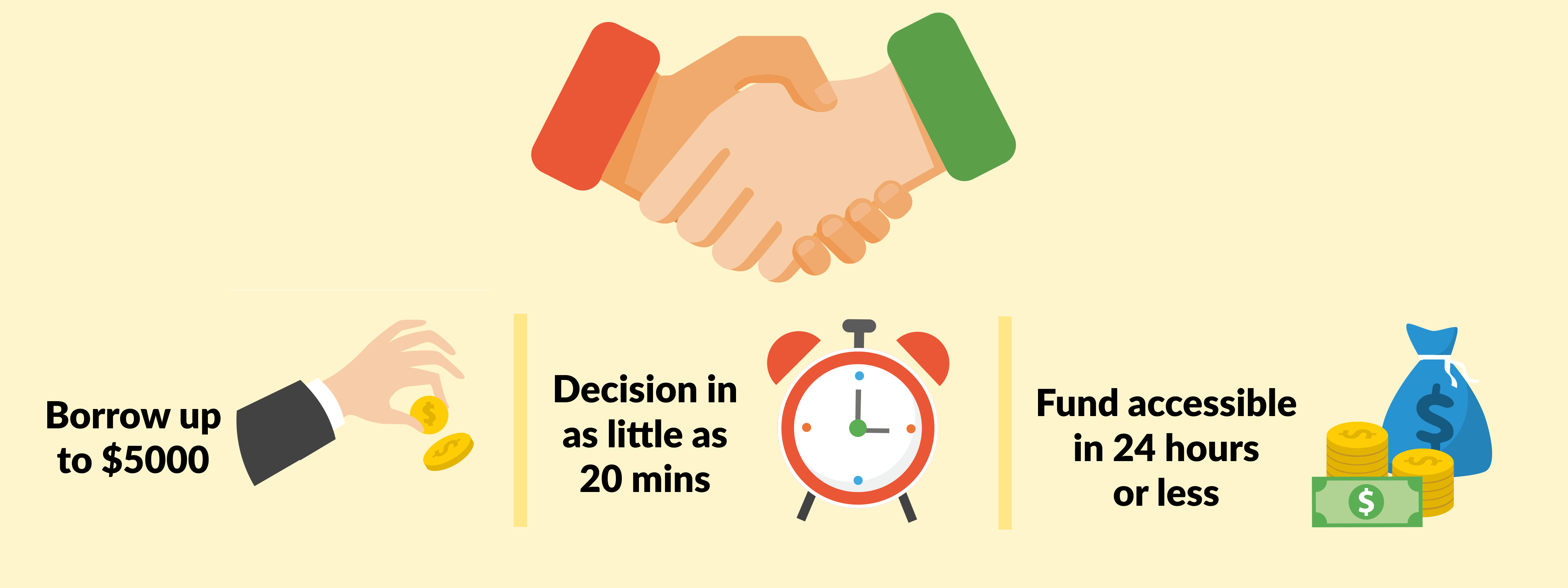

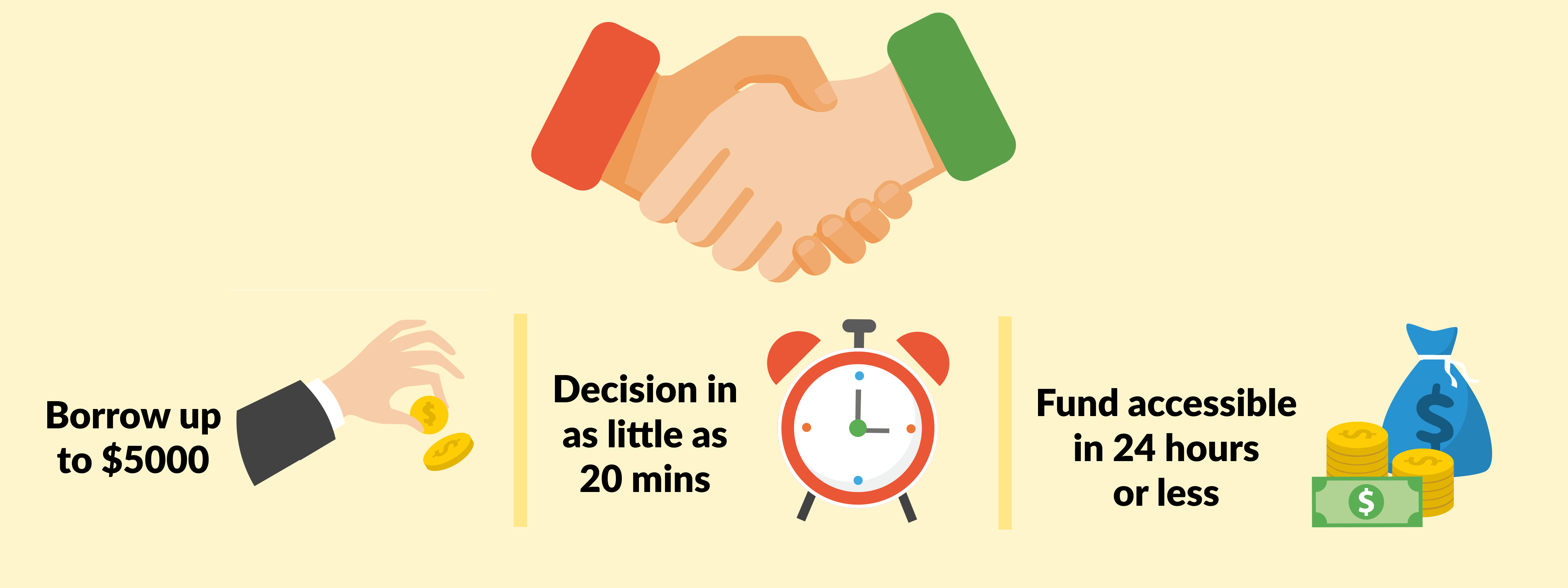

3. You will sign the contract and get the money within 24 hours or less.

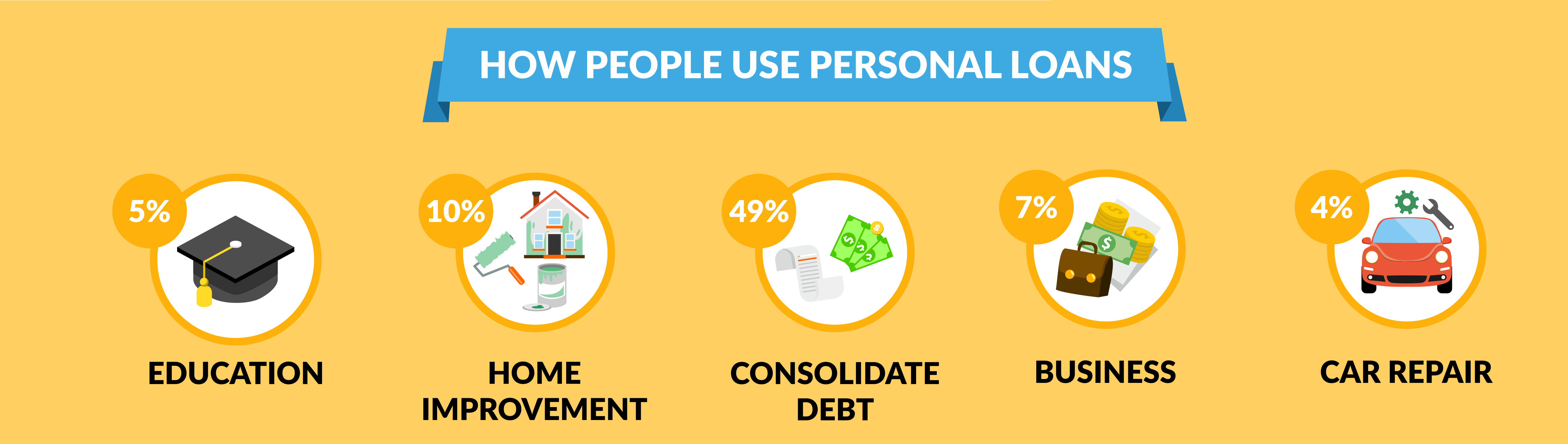

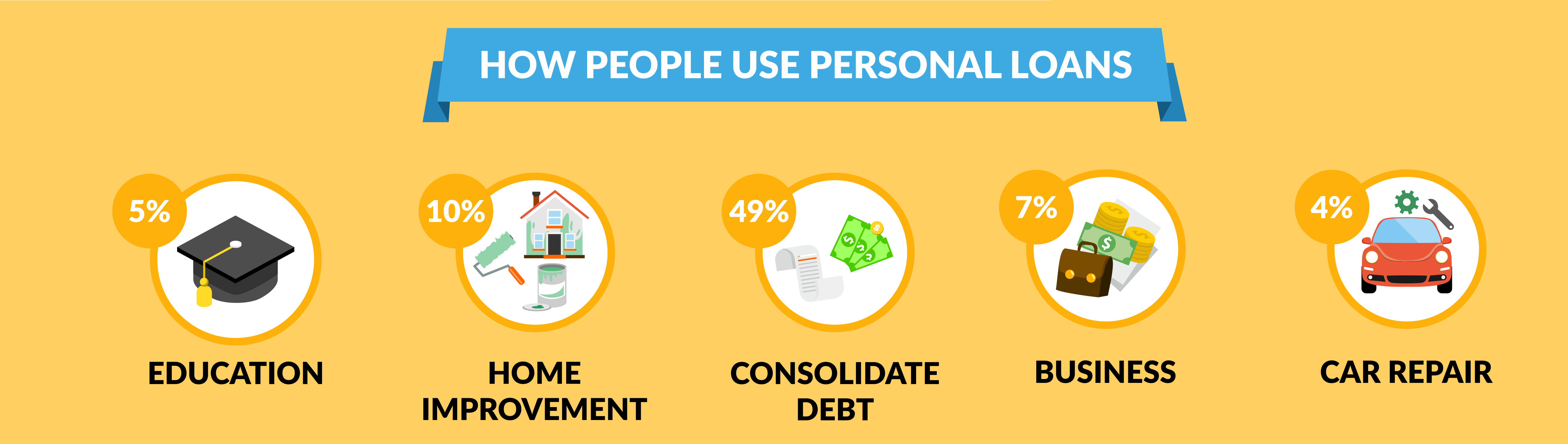

Loans for personal needs are some of the easiest and cheapest loans to attain. A personal loan is money that someone might take out to go on vacation, fix a car, pay some bills, or renovate your condo. These loans do not usually come in substantial amounts but can go up to $5,000 CAD. A lot of Canadians like to apply for them to cover emergency costs such as car accidents or medical expenses in Ontario.

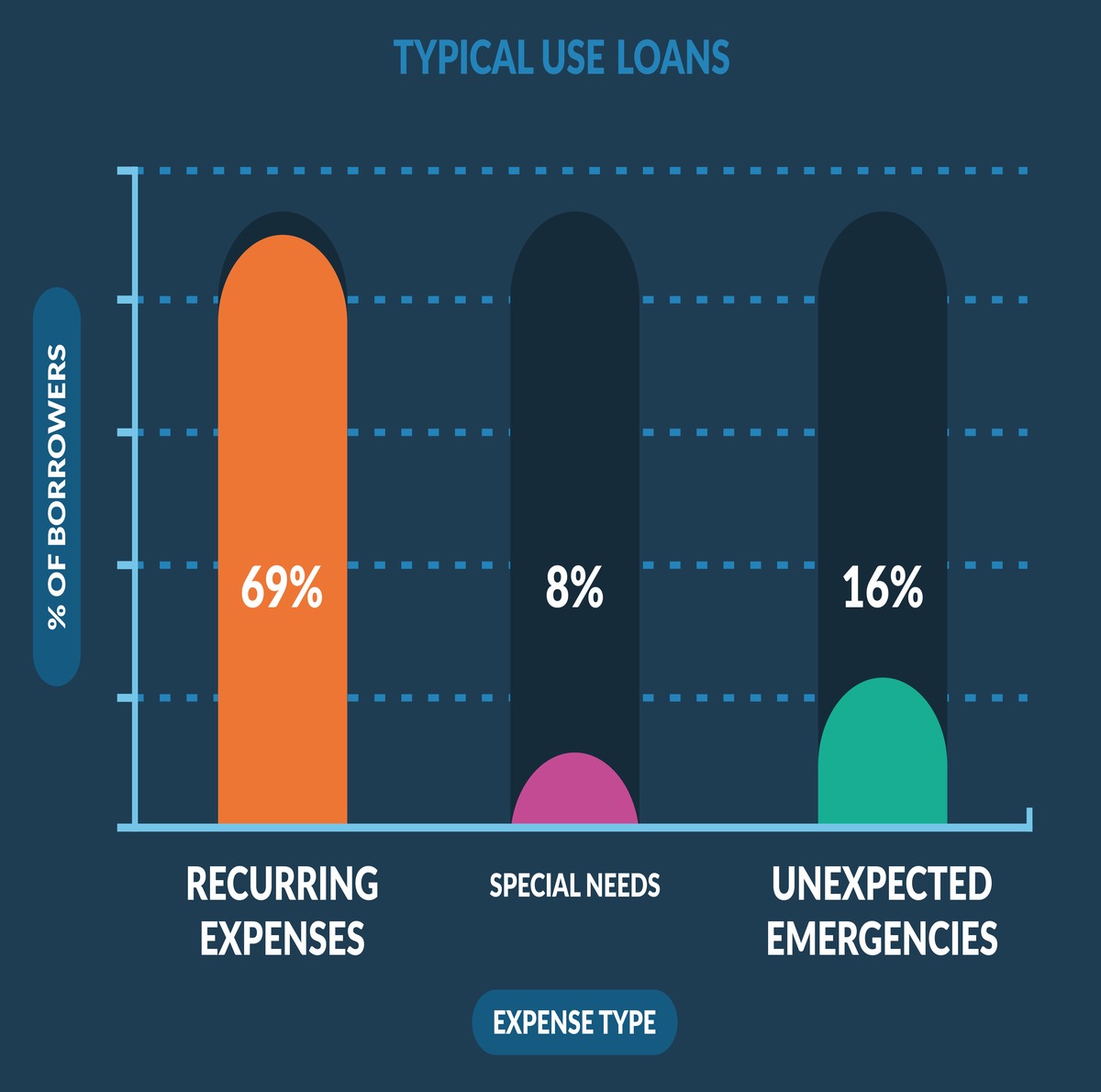

Most people borrow money in Ontario:

- to work on semi-large home repairs

- to put money towards education

- for a vacation

- for car repairs

- for other non-substantial things

These loans usually have high approval rates, so if you are looking for direct lenders who can guarantee you approval, you have great chances of being accepted. But this is not to say about big banks that will not approve people with no credit check.

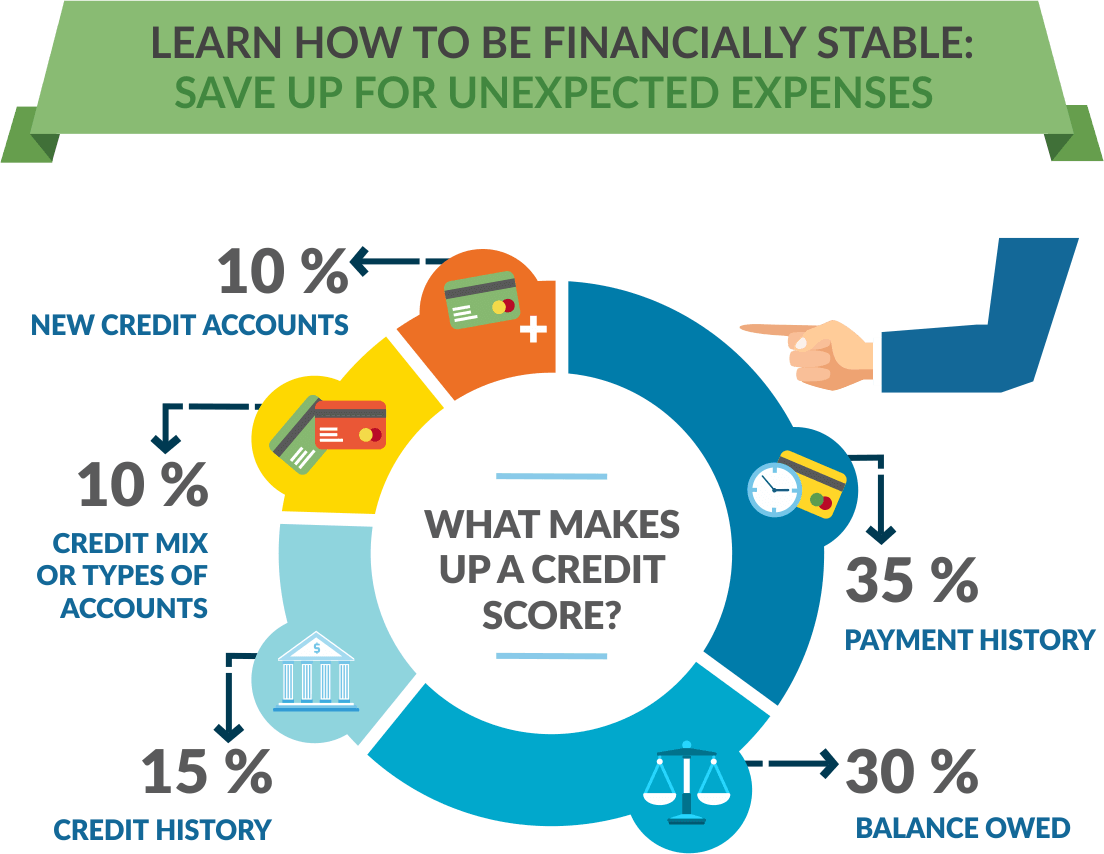

This money is very helpful to those looking to rebuild their credit score as most establishments report each payment made to credit bureaus such as Equifax and TransUnion. This means you can simultaneously get an instant personal loan to fund whatever project you want while also building back your score.

Loans in Ontario have been made easy to apply and qualify for. All you have to do is to register with them the appropriate documents and you could have a sum as large as $5,000 in your account the very next day.

The Best Private Lender For Installment Loans in Ontario

Private lenders are becoming more and more common these days. A lot of people facing rejections from big banks turn to lenders online in Ontario who offer no credit check. These lenders, as the name implies, are private individuals who have interest rates of their own. These rates are usually high since they want to make as much money as possible. More people are turning towards direct lenders in Canada since they feel cheated by big banks.

Low Interest Rate For Loans in Ontario, Canada

- Canada’s mortgage regulations are not very friendly to people who might be in a financial rut. They require high-interest approval rates that are just not possible for low income families. Thus, many people have chosen to look toward private lenders.

- People should be extremely cautious when dealing with private lenders as they operate in a completely unregulated environment.

- The law institutions of Canada have no control over private actions. Thus, it falls upon the borrower to make sure every aspect of their private lender is legitimate. However, with the high increase in people borrowing money from private lenders in Ontario, it seems that this is very much a legitimate practice.

Private lenders for personal loans in Ontario are also a very common practice. People usually feel nervous dealing with big banks and as such, they default to direct lenders. Lenders will have their own interest rates and will charge whatever they wish. Such lenders could not care less about your credit history but usually, need an assurance that they will get their payment in the future.

Almost all of us have this image of a Mafioso giving out personal loans and sending out their thugs to get their money back. But many Canadians have found the truth to be quite contrary to this. They insist that as a whole, dealing with private lenders was more hassle-free, easier, and faster than dealing with banks and establishments in Ontario. And their rating is simply better.

Top Online Loans Lenders in Ontario. Which One To Choose For Employed or Self-Employed?

Of course, it goes without saying that regular caution must be exercised when dealing with private lenders since there is no governing authority. This means that a lot of scammers or people looking to take advantage of someone in a tough spot will come out in full. Even if the ad says, "We will approve you", you should understand that not every lender does that. You must check all avenues before dealing with a private lender.

Step 1: Search for Private Lenders in Ontario

Step 2: Make a list of lenders you are interested in

Step 3: Check their responsiveness and reputation

Step 4: Examine terms and conditions offered by a lender

Step 5: Make sure you are familiar with their interest rates

Step 6: Read the company's reviews

Step 7: Sign the contract

It is usually a good idea to seek out previous clients of the particular private lender you are dealing with. Most people with bad credit in Ontario will be looking for personal loans to get them out of a tough spot. Thus, it is a good idea to be highly aware of the lender.

Ontario: Small Business Loans

Looking to finally start that small business, you have been dreaming of but do not have enough funds to make it a reality? The government of Canada also gives out loans to facilitate its citizens in starting up businesses. The Canadian government claims to have made over $9.5 billion CAD worth of loans to individuals looking to start their businesses.

Requirements to Attain a Small Loan in Ontario

- Eligibility is only for businesses that have under $10 million annual earnings.

- The Canadian government does not endorse businesses related to agriculture.

- They also do not approve loans for non -profit organizations, religious organizations, or charitable organizations.

Applying for a small business loan is as easy as going to your local financial institution and talking to an officer about how to procure a loan for your needs.

- This financial institution could be a credit union or a bank in Ontario.

- The financial officer will review your proposal and then if they find that it meets their standards then you receive the funds.

- The maximum funds one individual can receive is $1,000,000 by the government.

- Out of this amount, $350,000 can be used to buy a leasehold property.

- This money can be used to finance the purchase of viable franchises, commercial cars, and equipment (hotel or restaurant items, production etc.).

- These funds cannot go into goodwill or charitable projects.