There are different types of loans available in Canada that one can obtain from banks, financial institutes, and private lenders. No matter what the reason for obtaining is, you can easily find a lender in Canada because of the numerous options at one’s disposal.

Read on to know what are personal loans, why people apply for them, and how to apply if you have a bad credit.

Why Do They Call Them Personal?

A loan for personal use is a type of loan in which the borrower repays the amount to the lender in fixed installments after receiving the funds. These are generally short-term money; however, in some cases, the period of repayment of the amount can be extended.

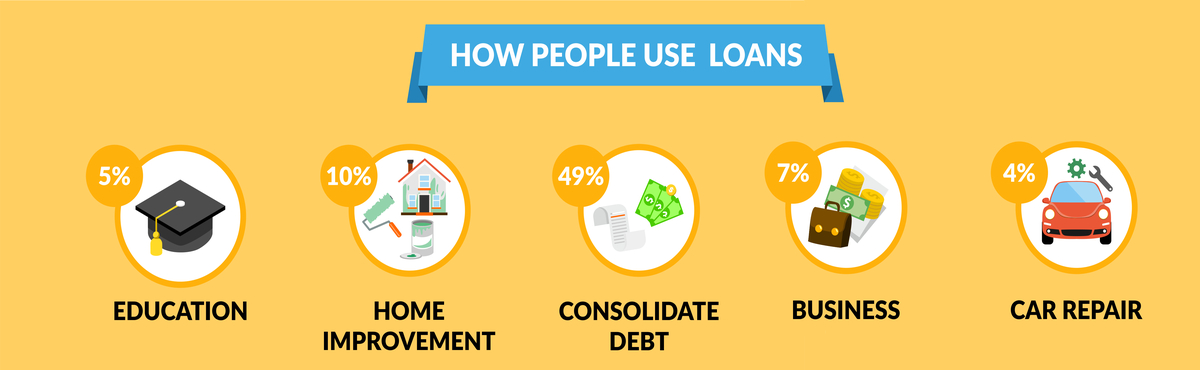

This type of loan is suitable for a number of reasons. Whether you have outstanding bills to pay or want to purchase an expensive commodity, you can apply within minutes.

We offer:

Why Are They Popular in Canada?

Here are some of the reasons why people love these loans:

- Easy to apply

- A simple solution to get quick money

- Can be obtained without having an asset

- Easy to repay

- Fixed interest rate

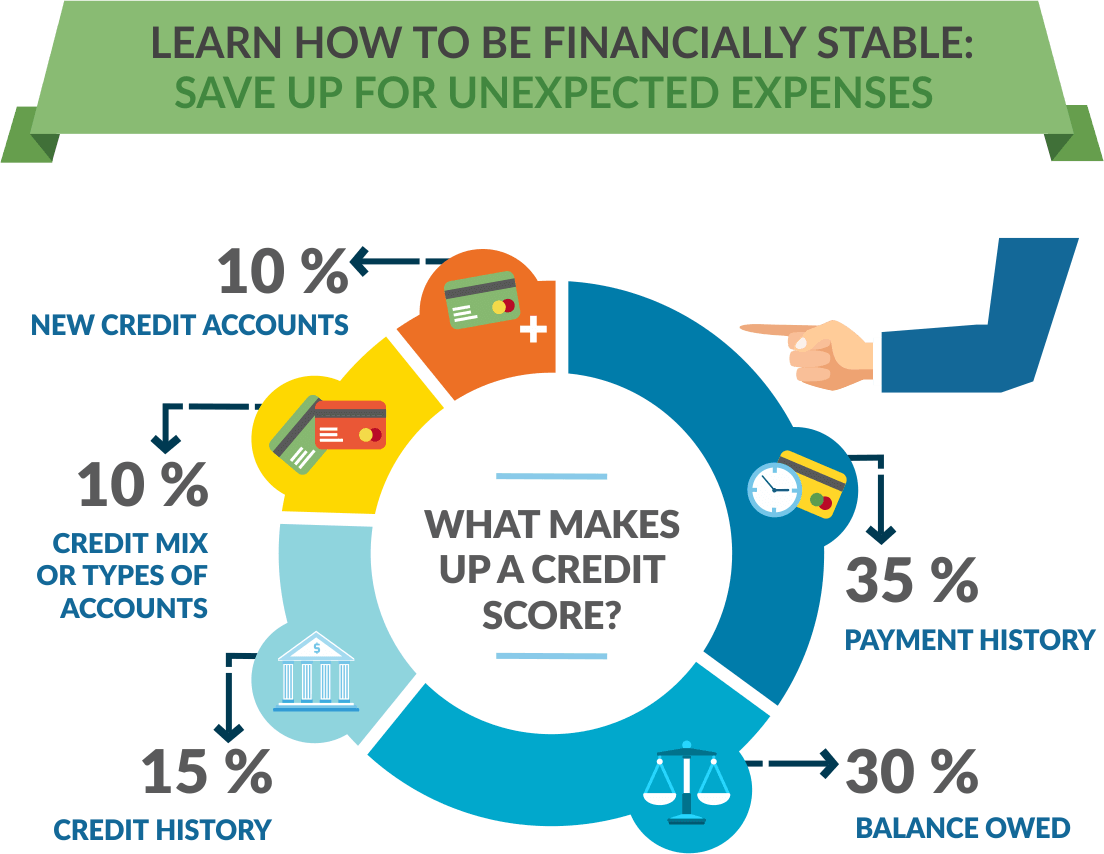

- Can help to improve credit score

Online Loans Vs. Money-lending Stores - Learn More

How to Apply If You Have a Bad Credit?

It is commonly believed that people who have a bad credit find difficulties in borrowing. This is partially true since many banks and financial institutes do not entertain the applications of people with a low score. However, there are many private lenders in Canada who can come to their rescue.

Another common myth is that they are available at a high rate of interest. This is again untrue since, with a little research, you can find numerous private lenders who are ready to offer you loans on easy terms and a lower rate of interest.

What is the Process?

1. The first thing you need to do is find a reputed and reliable private lender in. For this purpose, ask your peers, family members or friends for recommendations. It is recommended to select more than one lender and then compare the interest rate, terms, and conditions.

You can read reviews on the Internet to check whether their previous clients had a pleasant experience with them or not.

2. Once you have finalized a lender, fill out the application form. Generally, it does not take much time as many companies provide the convenience to applicants to apply online through their website.

3. Once accepted, you will be asked to sign contract documents, and the money will be given to do. While signing the documents, it is advised to carefully go through them and understand all the terms and conditions.