As they say, what goes around, comes around. If you have made mistakes in the past when it comes to credit then you are aware of what bad credit is.

It all comes with the carelessness that you show while spending your money or while paying back that loan you took from the bank. For those who are not aware of credit score, continue reading!

What is a Credit Score?

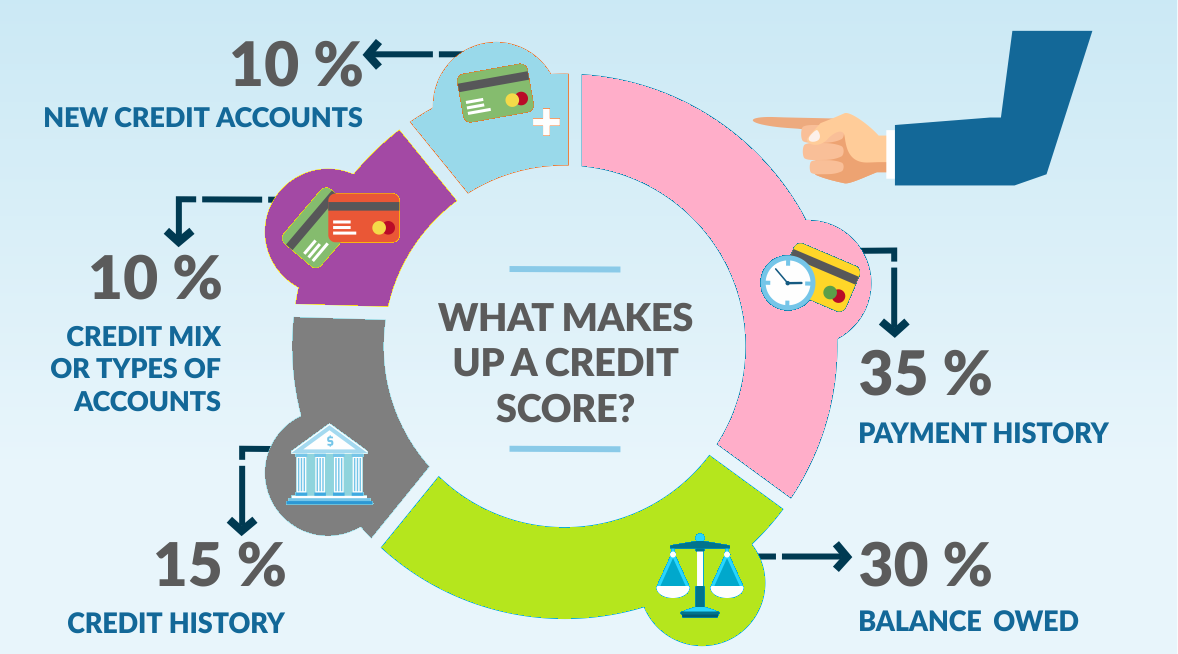

A credit score is a number that is an overall analysis of an individual’s credit files. It shows whether a user is creditworthy or not. Most of the lenders check the history of the borrower before giving a loan to them.

However, this is not our main concern. We are here to guide you on how to get a bad credit personal loan with guaranteed approval.

Don't Forget to Check Our Latest Hot Topics!

- Truth About Bad Credit Loans with Guaranteed Approval

- What You Should Expect From Instant Unsecured Loans

- Personal Loans for People With Bad Credit. Fast Help!

- How Bad Credit Score Can Affect Your Life

- Easy-Fix for Your Credit Score

87% of Bad Credit Loans Applications up to $5000 are Approved.

1. Consult Credit Unions

2. Private Direct Lenders in Canada

3. Family and Friends Option

4. Collateral

5. How to Get a Bad Credit Loan from Private Lenders with Low Monthly Payments?

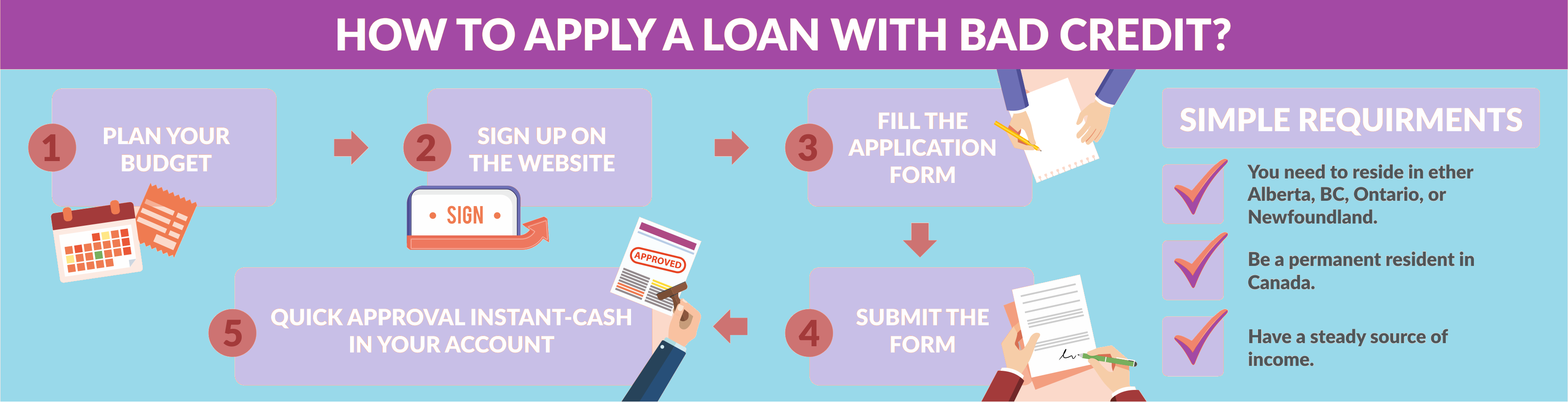

Yes, you read that right, you can get this money in Toronto, Ontario, and other cities in Canada with instant approval and, if lucky, with no credit check. There are a number of direct lenders offering bad credit funds. Read till the end to know more.

Consult Credit Unions

If you have a poor financial history, consider consulting credit unions that offer bad credit personal loans in Canada with guaranteed approval. Most probably your request will get accepted here. They are like banks but on a smaller level.

- The best thing about Credit Unions is that they will not see your credit score or any other numbers that you have given on your loan application.

- They will treat you like a person who is in need and will understand your requirements.

Private Direct Lenders in Canada

For those who don’t know what a loan from direct lenders is, it is a loan that is not given by any traditional bank system. In fact, it is given by the private are not looking to lose their money at all. Hence, the amount has to be repaid.

The Truth About Online Lenders

- They have no boundaries when it comes to credit score. The loan rates will surprise you once you have a look at them. We would say that it is a very decent option for people in Canada as banks cannot compromise with you.

- You can visit different private lenders websites where different lenders and borrowers come together to make this thing happen. It is a very easy process to get a loan as compared to the other ones.

Look for Friends and Family

This one can be quite tough but this can be better if this goes right. Try asking your family members or friends if you want a loan. They will understand you more than any bank. At the end of the day, they are the people who you can trust and rely on. They know what you are going through and what you need exactly.

The good thing about and friends is that they will compromise with you even if things don’t go right. You don’t have to follow any rules or deadlines. If you are thinking of returning their money, this is where you have to mark your words.

Tell them when you can return their money and give them back as soon as you get your own money. This will make a good impression of yours and they can trust you when you get in trouble next time.

Use Something as Collateral

This is a very rare case but can work for you to get the loan. If you are having issues in approving your loan, try keeping something as a collateral. Banks, in general, accept collateral for approving the loan application.

There are certain things to be kept in mind when using something as collateral. These factors include its value, lifespan etc.

How to Get a Bad Credit Loan from Private Lenders with Small Monthly Payments?

These are some of the tips that you can follow to get loans faster:

- Tell your whole story. Let the lender know what you are going through.

- Explore multiple options

- Search for lenders online. Don’t bump into some scam firm and bring more problems with you.

Try following some of the tips above and you will see a positive feedback. In the end, we would say that one must be careful while using their credit so that they don’t get into issues like these. Loans can be a big pain if you don’t pay them back on time or earlier.