Before now, building your credit score used to be very difficult, and young people were not able to borrow money easily due to insufficient history.

Since younger ones were not allowed to borrow, building a history by such means was extremely difficult because of the likelihood of financial mismanagement.

Nowadays, there many tricks and techniques young people can use to accelerate their financial scores, but it still boils down to being responsible for financial matters and lifestyle. Growing up comes with lots of financial responsibility and gains too.

Current situation

Now, the rules have changed dramatically; young people find it easy to accumulate credit scores as the need arise. With the advent of card companies, young people now have equal access to a credit account as long as they can provide a valid name.

- What You Should Know About Credit Score

- How to Calculate Your Credit Score

- Benefits of Having a Good Credit Score

- Why Credit Score is Important?

Building good is a huge bonus, as it would help you qualify for loans, cell phone plans, auto insurance, and rental applications. One mistake most people make at the onset is applying for too many credit accounts.

A potential lender will always check up on your existing record whenever you requested for credit. If your record shows no history but rather several applications made for different accounts, it shows that you might be in financial trouble and just sourcing for funds to increase your debts, so the lender may not approve it.

Deciding On The Loan Amount

Deciding on the specific amount of credit you will need on a monthly basis should be the next thing after you have successfully applied and gotten the necessary approval from a company.

Ensure it is a reasonable amount that you can afford to pay easily; you can then deposit the said amount into the bank as collateral. Although this is not a required step, it will increase your chances of acceptance by credit companies. You need to focus on building your rating as soon as you receive your credit card.

However, in order to boost your score quickly, you will need to avoid borrowing above 30% of your limit and ensure you make payments as soon as they are due. If you exceed more than 30% of your limit, it can reduce your borrowing score, and another important thing is that most lenders are always interested in your paying habits, to know if you always keep to time and if there are any defaults on your profile so far.

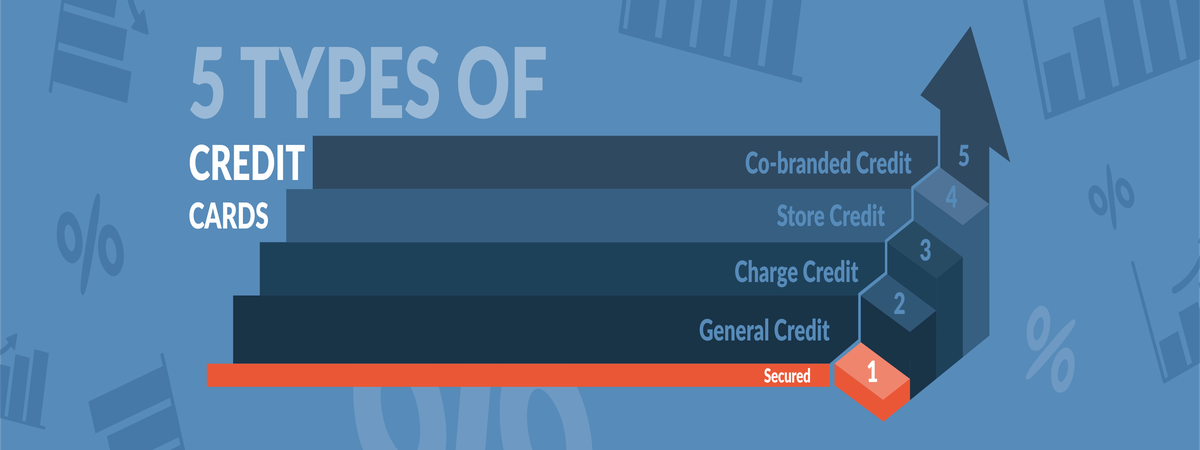

Getting a Credit Card

- A credit card can directly influence your financial score depending on how you use it. A regular and responsible use can boost your score.

- Note that each time you open a new account or close an old one, it lowers the average age of your credit accounts, and this can affect your credit score.

- Keep in mind that credit companies are in the business of lending money to make profits too. If you establish the habit of paying your bills out rightly, the companies make no money off you, because the transaction will generate no interest charge on your account.

To boost your credit score continuously, you should borrow money and pay it all once a month. If you maintain such habits over a long period, you will see your credit score increase drastically.

Improving Bad Credit

If you are new to credit card usage or you have made an unwise use of your card in the past, or probably some mistakes that you find very difficult to correct, it is not too late as you can still make amends and see positive results.

However, it is unlikely that you will get the best results. Being rejected for loans / bad credit loans or apartments' rent can be disappointing. Whether your goal is to own your house, plan a vacation, or sponsor an education, everything can be achieved with adequate planning, discipline, and commitment.

Setting goals helps you to stay focused and ensure you do not lose track or wallow in the stream of unnecessary spending and extravagant lifestyle because you now have access to credit.