A credit report is a report card that allows you to manage your financial situation properly. It is a journal that shows how your transactions are carried out, the amount of debt you are owing, and your account management status.

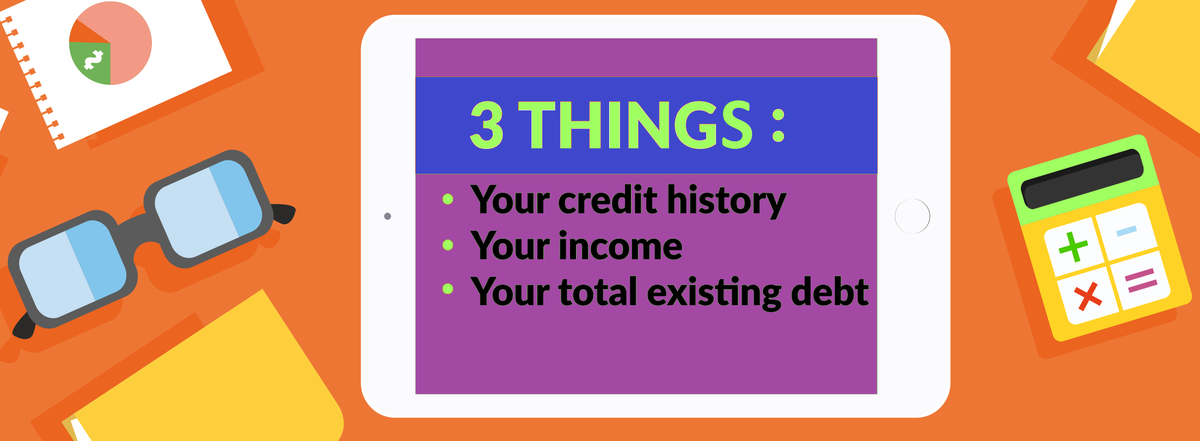

Most money lending companies today make use of report cards as major criteria to discover your financial record and status. They use it as a metric to ascertain the amount of debt you may owe and other purposes covered by the federal law before granting you a loan.

Let us explain you in details what a credit report is and why it is important for every Canadian.

We offer:

- Bad Credit Loans

- Personal Loans

- Unsecured Loans

- Bad Credit Loans Guaranteed Approval

- Fast Loans

- Installment Loans

- Micro Loans

The Importance of a Credit Report

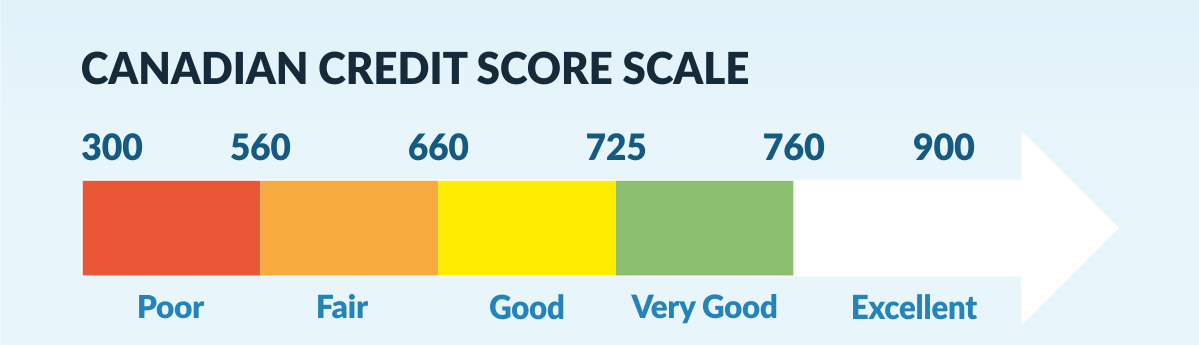

A credit report is a very important financial record in your life. It serves as the basis of your financial scores, which are numbers that illustrate your financial life.

You should have a positive score if your report shows that you have been making on-time payments. This will influence your financial life to the extent that you will get favorable credit cards and loan terms.

Late payments and poor financial management will result in low scores. This will mitigate your chances and make it harder to secure a suitable credit card and loan terms.

How to Read a Credit Report

A credit report is divided into three main parts:

- A section contains your personal details such as your name, employers, and address.

- Account information like auto loans, mortgage loans, credit accounts, and other accounts.

- Public records, which include lawsuits, tax liens, and bankruptcy history.

Read More: Common Mistakes on Your Credit Report & How to Understand Your Credit Report

How Information on a Credit Report Is Obtained

The information contained in your credit report can be accessed by various credit reporting bureaus such as TransUnion, Experian, Equifax. State and local governments, courts, and collection agencies can also add some information to your credit history.

Law to provide the information regarding your financial dealings with the credit reporting agencies is not applicable to companies. However, on a monthly occasion, most organizations submit reports on the status of accounts to the credit bureaus.

When Should I Get a Credit Report?

You should have your credit report ready a few months (about 2-3) before any major purchase. It is important that you carry out a thorough review in order to identify the accounts listed and the terms and conditions displayed. You can apply for a dispute once you find information on your credit report unclear and inaccurate.

Reviewing Your Credit Report

Looking at your credit report, make sure you are familiar with all the accounts in your report. If not, contact the company to find out to report on any mistakes or cases of an identity theft.

- Determine your credit usage by looking at the limit shown in an account, and then check the status.

- How clear is your old account? Loan lenders want to see the long history of good credit habits.

- Is there a good mix of credit types such as credit cards, car loans, and mortgages?

- When reviewing your report, make sure that you have defined all accounts listed in your report.

- Make sure the account information has a unique account status. Otherwise, contact the company before initiating a dispute.

- Determine the utilization rate by examining the limit shown in an account and checking the reported fees. Credit over 30% can negatively affect your score.

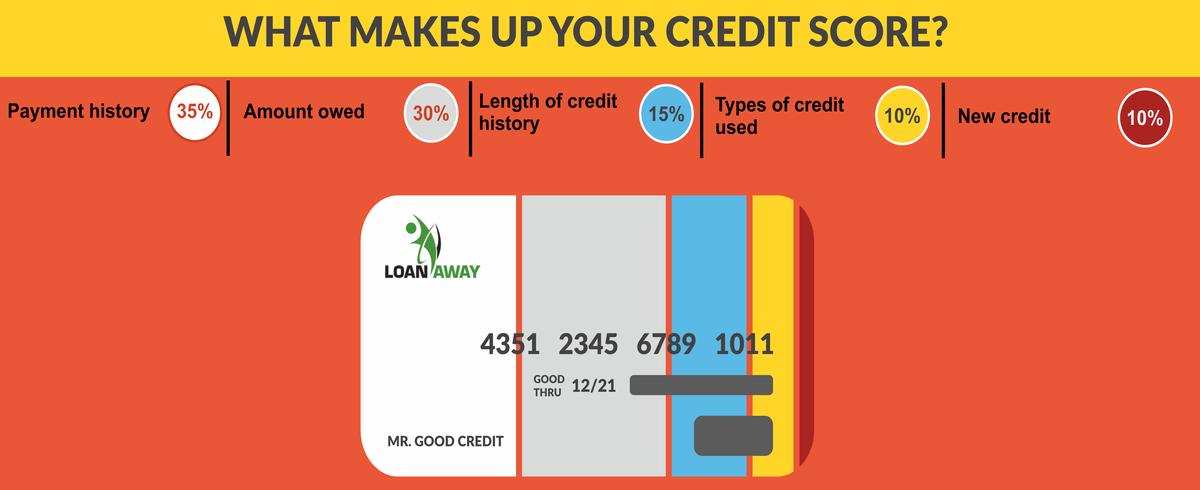

How Information In Your Credit Report Determines Your Credit Scores

Every piece of information contained in your report affects your financial scores. From the debt and payment history down to credit use are important in determining your credit score. You should always make plans to improve your credit report and score.

A credit card is a useful tool to acquire a wide range of loans. You should get your credit report today and start building your credit score.\

- How Can I Rebuild My Bad Credit?

- How Can I Raise My Credit Score In 30 Days?

- Is 550 a Bad Credit Score?