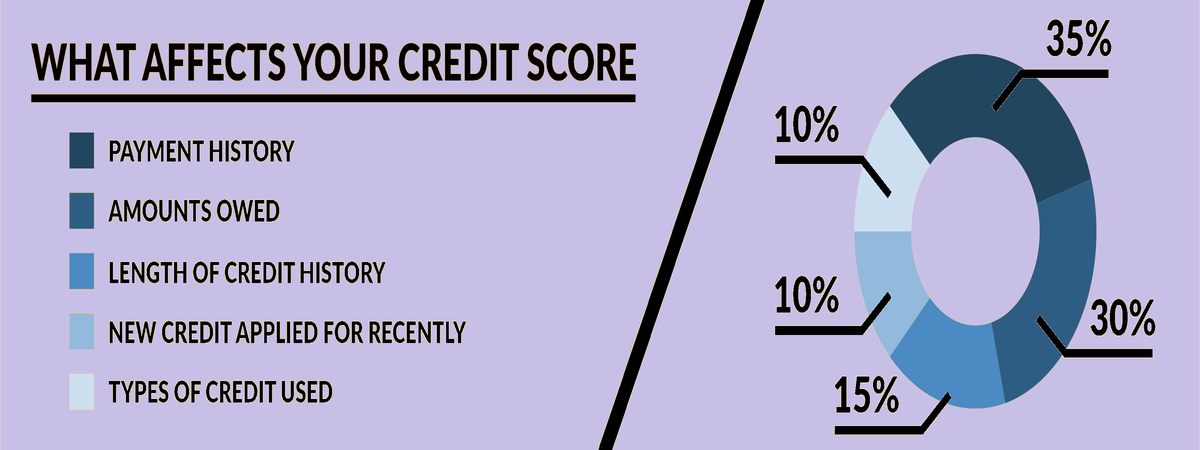

A bad credit score can create a lot of problems. If you have an immediate expense to deal with or want to take out a mortgage, you will be unable to do so. It is also stressful because it is unhelpful towards a debt situation if you have one.

Fortunately, you can adopt several methods to improve the score. Generally, it takes time and persistence but there are a few ways to have a quick improvement.

In this post, we discuss a number of methods that are helpful for a fast rise in the financial score.

Methods for Quickly Fixing the Credit Score

If your credit score has been lagging and you need a quicker fix, then the following methods have been known to work well:

- How to Build Your Credit Score?

- Everyday Habits That Will Boost Your Credit Score

- How Can I Rebuild My Bad Credit?

- How Can I Raise My Credit Score In 30 Days?

Credit Utilization

You should get your credit utilization rate less than 30%. To understand what a utilization level is, you should know what your credit limit is and how much you owe. The ratio of both these numbers is known as the credit utilization.

For example, if you have a limit of 10,000 dollars and your balance is 5,000 dollars, then your utilization is 50%. To get it below 30%, you should pay down your balances

Increase Your Credit Limit

On the other hand, it is possible that your current financial position does not allow you to pay down the balances. In this case, you can request an increase in your credit limit. You will have to call the bank or lender and negotiate an increase.

Suppose you have 1,000 dollars limit, which you have maxed out. If you can negotiate to increase it to 2,000 dollars, then you will have cut your utilization level to half.

Check Your Financial Report

It is quite possible that there are inaccuracies in your credit report. You can experience a quick boost in your score if you can manage to get these removed. You must call the lender/bank to dispute the false information. You can also dispute outdated entries or those that cannot be verified.

Also, make sure that you follow up by reporting the same inaccuracies to the three credit bureaus.

Property Rent Hack

If you happen to pay rent of your residence, then you can use a great hack for improving the score. Simply add the rent payment history to your report. You are bound to experience a quick boost in your score. However, for this hack to work, you must be paying your rent on time.

Get Rid of Your Debt

The debt that comes from the credit card is considered as the bad debt. The reason is that it considerably lowers your score. So if you have debt from more than one source, start by paying off the credit card bills.

On the other hand, you can replace the bad debt with a good one. For this purpose, take out a loan that can be paid back in installments.

Conclusion

Before following any of the above methods, you should first have access to your credit report. There are 3 major credit bureaus in Canada; namely Equifax, Experian, and TransUnion. According to Canadian law, you can request one credit report for free every year.

After you have acquired the report, it is time to examine it thoroughly and understand the details. Only then you will know what steps might be more feasible for a quick increase in the score.