Money is a thing that keeps everyone on their toes these days. Even if someone is financially sound, they are always worried about staying that way. Costs and expenses are on the rise, especially when people want to maintain a certain quality of life.

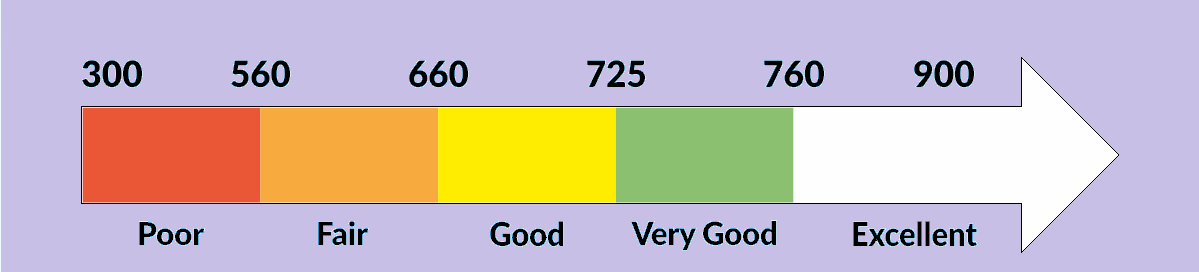

Part of one’s financial health is the credit report or the financial score. Whether you have always had a reasonable score or have just managed to improve it, your next step should be maintaining it that way.

While you are trying to build your score up, we will tell you how you can get approved for loans even with a poor financial history.

How To Get Approved While Building Your Score

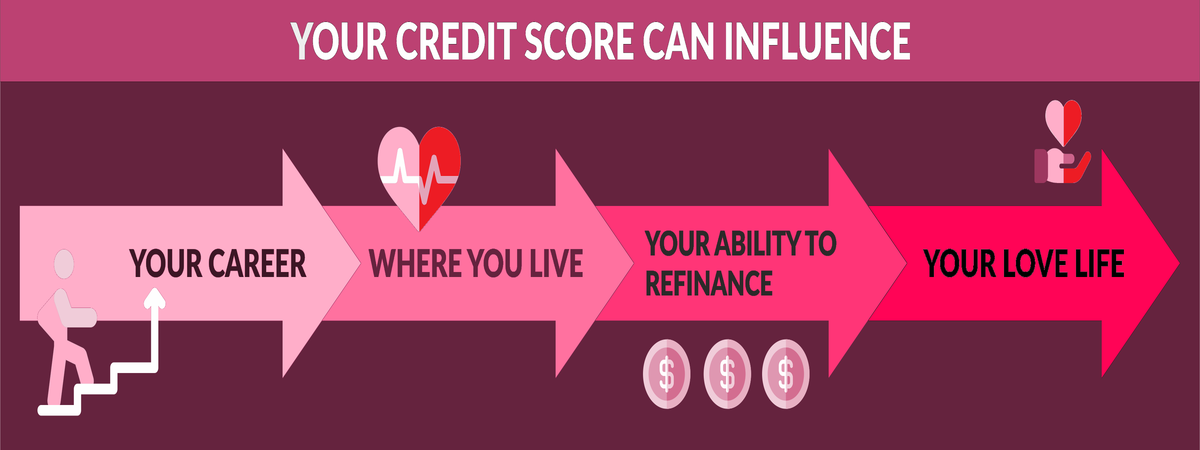

A credit score is not merely used for borrowing purposes. It is also checked by certain businesses and employers when hiring an individual. Additionally, a landlord may require a credit report to judge a potential tenant’s ability to pay rent on time.

Generally, a good score makes you less stressed about your money issues. Therefore, if you have a high score, it becomes significant to maintain it that way. However, it takes dedication.

If you have not been very successful in managing your finances, you do not have to worry! There are still lenders out there who can help you! Keep reading.

We offer:

- Bad Credit Loans

- Personal Loans

- Unsecured Loans

- Bad Credit Loans Guaranteed Approval

- Fast Loans

- Installment Loans

- Micro Loans

Maintain a Good Score and Get Qualified For a Loan

Now that you know how important it is to maintain a good score, you should know about methods that can help you do so. Here are 3 easy methods to keep your score at a good level.

1. One of the mistakes many people make is treating varying debts with different level of attention. When it comes to paying off your debts, treat all types equally regardless of lower or higher interest rates. Consider your revolving and installment debts in the same manner.

Example of revolving debt is credit card and mortgages of installment debts. Even if a certain debt has the lowest interest rate, you should not ignore that payment in favor of others. If you keep ignoring such payments, you will ultimately end up with a suffering credit score and will find it hard to get the desired approval for loans.

2. Many people have more than 1 credit cards. It obviously means that there are several debts spread out through your credit report. Not only it makes it a complicated report but difficult to manage all the payments separately. A good idea is to consolidate the debts. You can pay all the debts as a single loan.

3. You must keep your credit utilization rate below 30 percent. Understanding the utilization rate is not difficult. It is the comparison of your credit limit with what you owe. Consider the example of having a limit of 10,000 dollars. Now consider that you have a balance of 5,000 dollars. This means that your utilization rate is 50 percent

General Financial Behaviors to Help With Bad Credit

The way we live and use our money can greatly impact the health of our score. There are some general healthy habits one can adapt to improve financial issues.

Nowadays, people have become excessively inclined towards using a credit card. You should totally reduce this habit. The more you use the credit cards, the more risk of debt you have.

- Secondly, don’t buy stuff that you don’t need. If you look around yourself right now, you will find stuff that you spent considerable money on but it has never been used or provided little value in your life. You will be surprised how much better your finances can become if you stop buying such things. In fact, you might just earn a little if you can sell these now.

- Lastly, one should strictly develop the habit of saving money. Life is unpredictable and you never know when unexpected expenses may occur. Savings make you feel stable, less stressful, and responsible for the future.

Read More: