Loans are required when one falls short of money. This is not an uncommon situation these days. Saving reasonable amounts of money has become difficult because expenses and costs are on the rise.

Unexpected expenses such as a car repair or home maintenance can be costly. This is why most people often take out loans.

On the other hand, it is not as easy placing a simple request at the bank, becoming approved, and access the funds.

Loans have certain qualification criteria that could vary depending on different types of loans and from lender to lender.

Check Or Not To Check?

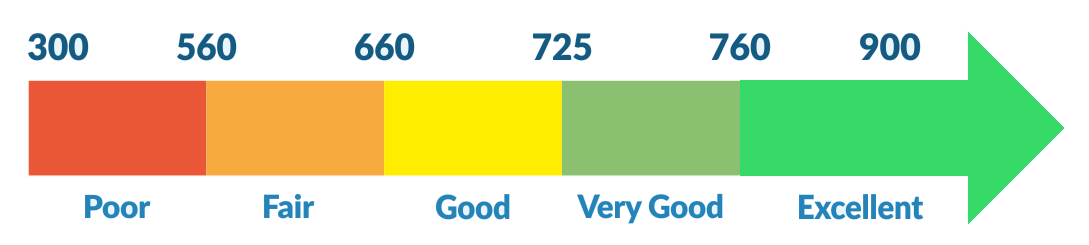

One of the major loan requirements is a credit check. If an individual has an excellent or good score, they can become approved with little hassle. But those with fair or bad scores will face certain complications.

In the following article, we describe what financial score is and what counts as fair and bad credit. You will also learn how to acquire unsecured loans with no credit check at all.

- Loans Canada

- Loans in Ontario

- Loans in Alberta

- Toronto Loans

- Online Loans

- Fast Loans

- Instant Loans

- Edmonton Loans

- Calgary Loans

Explaining Score

A credit score is the rating provided for an individual’s financial report. The report is a history of payments made by a person such as rents, card purchases, bills, etc.

The score describes one’s ability and responsibility to pay back the borrowed money. So if the report consists of a significant number of late payments and debt, the score will be poor.

Typically, a score of 780 and more is considered excellent. A score of 680 and more and one that is 640 or more is called good and fair score respectively. When the score falls below 640, it turned into bad credit.

Why Is It Unsecured?

Unsecured loans are those that can be acquired without presenting the collateral. The collateral is a personal belonging of significant monetary value. It could be a car, home, piece of jewelry, etc.

In the case of borrower default, the lender seizes this collateral to reduce their financial risk. When you apply for an unsecured loan, only the financial history and proof of income are checked. However, it is now possible to obtain these without a score check at all.

What To Do?

For this purpose, you will have to find online lenders that specifically make this offer. Since many people suffer from poor scores and seek such loans, the online financial market has responded with plenty of options.

These lenders don’t check your entire history. Instead, they only conduct a soft check; looking only at the score and some other factors such as employment, income, etc. They decide how much funds you can borrow based on your score.

This considerably reduces the complications and stress of applying for loans when your history is not up to the mark. Additionally, these lenders also offer quicker approval times so you will have access to the borrowed money quite soon.

Finding Online Lenders

A simple search of no credit check lenders will yield a lot of options. You must compare based on a few factors to select the most reliable and suitable lender. These factors include company history, number of successful approvals, reporting to credit bureaus, loan policies, etc.

Online lenders typically provide detailed information on their websites. Once you have selected one, you can access the provided online loan application form. Once you have been approved, it is important that you pay back the loan money on time and try to boost the score.