In today’s time, it is normal to come across the need for immediate cash. Expenses and costs have both been on the rise.

While people do try to save, it is not always possible or the money will fall short given that some expenses are sudden and costly.

In such situations, personal loans can be quite helpful. Both large and small amounts of cash can be borrowed.

Also, a variety of personal loans are available, so the borrowers can select depending on their circumstances.

Where To Get Loans?

Loans can be acquired from banks, credit unions, and direct lenders. Additionally, it has become easier to apply for loans because of online processes. Not only this is incredibly convenient but reduces the times of approvals as well.

Installment loans can become a bit complicated to obtain if your credit score is not up to the par. While there are some typical requirements for the score, some lenders may vary their policies slightly.

- Loans Canada

- Loans in Ontario

- Loans in Alberta

- Toronto Loans

- Online Loans

- Fast Loans

- Instant Loans

- Edmonton Loans

- Calgary Loans

Understanding the Credit Score

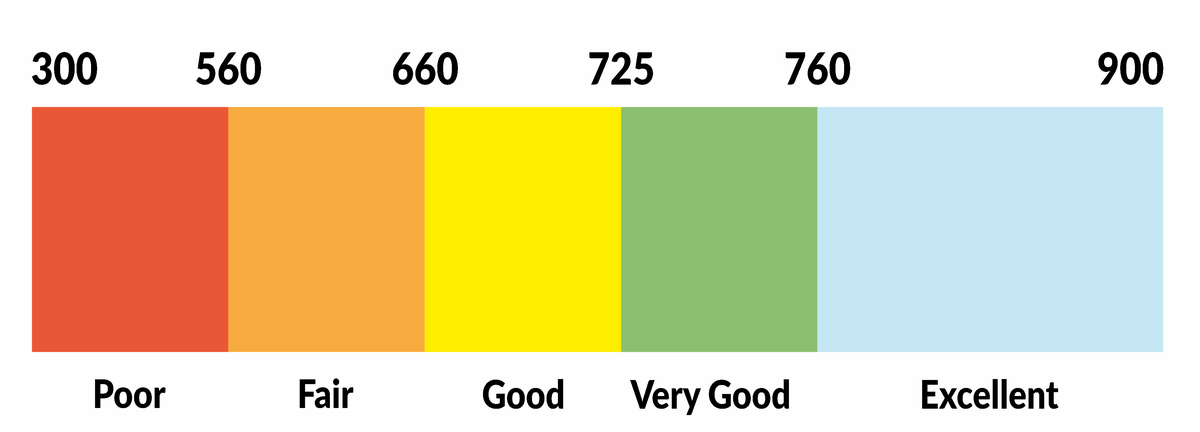

The credit score is the rating provided on your financial report. A report contains information like previously borrowed loans, debts, late payments, rent, bills, etc.

If the number of late payments, debt, and collection accounts is higher, then the score becomes lower. Lenders check for scores in order to determine the ability and responsibility of the borrowers to pay back the loan. It is required to reduce their risk.

Score Standards

A score that is of 780 or more is considered an excellent one. One that is 680 or more is known as good credit while that of 640 or more is considered fair. When scores fall below 640, they are known as bad.

Can I Improve My Financial History?

While it is possible to apply for installment loans with bad credit, there are certain methods you can use to improve your score at the same time.

Some quick methods can fairly improve the score, which gives you a boost in your application process.

Read More: How Can I Fix My Credit Fast?

Applying For Installment Loans

Banks will likely reject you if you have a bad score. That is why it is better to apply using direct lenders. All you need to do is find one that is reputable, reliable, and meet your requirements.

You can find plenty of information on the companies’ websites. Most of them have well-established websites and this is the first sign of authenticity. On the website, look for information on company history, policies, approval times, testimonials from previous borrowers, and if they report to credit bureaus.

Final Step

Shortlist several lenders and compare them. Once you are satisfied with one of them, look for their online application form. Fill out the information and submit. The lender will then send you a contract if the application is approved.

Sign the contract if you agree with the terms and conditions. Upon receiving the contract, the lender will directly transfer the money into your provided account.